Anyone that has an Instagram account (please follow ours) or watches the news has likely heard by now about the great Gamestop Short squeeze this week. The struggling stock — GME — which was largely hovering at prices under $10.00 for nearly all of last year, finished at $325.00 per share at market close on Friday after ballooning to $483.00 at one point. The previous Friday, the stock closed out at around $60.00. The accelerating price growth was driven by a reddit page called r/Wallstreetbets, whose membership has more than tripled since the stock made the news. The page is a self-proclaimed collection of degenerates willing to gamble away any money that they have — especially government “stimmy” checks — on options. This time, it paid off for many, with some up as much as $30 million. So what exactly happened that drove the price of Game Stop thought the roof? We’ll explain below:

Step 1: Someone Shorts the Stock

Short selling is an excellent way to hedge the risk of a decline in the price of equities (stocks) so many people choose to sell stocks short if they feel the market or an individual stock is at risk of a decline. In the instance of Gamestop, many people felt that the brick and mortar video game seller would get pummeled by the pandemic. While people are still gaming in 2021, brick and mortar retail stores are performing poorly during the pandemic. Gamestop, for example, had a net income of $-18.8 million last quarter with a drop in revenues of 30.16%.

Enter Citron research and Melvin Capital — two massive hedge funds with huge short positions in the company. Shorting a stock is placing a bet that a stock declines in value. To do this, you borrow shares from someone else and sell them later through a contract for a small fee. It’s lucrative because the cost of a contract isn’t usually a lot compared to the prices of a stock. If the stock declines, you win big. We’ll explain how it works below:

If a stock is currently $100.00 and you think it will go down, you can purchase rights to a contract to sell it for $95.00. This might cost you $0.50 per share borrowed (hypothetically speaking — the pricing is based on a complex formula). When it comes time for the contract to close, you have to purchase shares to fulfill the contract. You make money in this scenario if you purchase the stock at less than $94.50 but you lose money if you pay more than that amount.

For Gamestop stock, over 100% of the shares were sold short. This means a ton of shares were borrowed — so a lot of people had interest in the stock’s decline.

Step 2: Long interest and Short Squeeze: Enter the Redditors

Eventually, it comes time for options contracts to expire. With over 100% short interest in GME, a lot of people were banking on the stock’s decline. Redditors — especially one person named Keith Gill who goes by u/deepfuckingvalue on Reddit were encouraging other redditors to buy. The Reddit site r/wallstreetbets had over 1 million members at the time — a considerable army of retail investors. With an army that called themselves the GME Gang, the retail investors purchased thousands of shares of GME and drove the price up. As the price increased in value due to excess demand compared to supply — classic economic principles — the shorts had to cover their positions as their contracts expires.

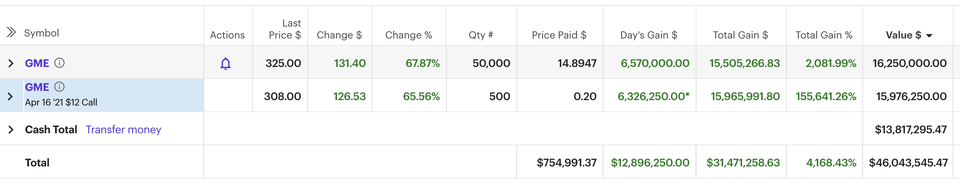

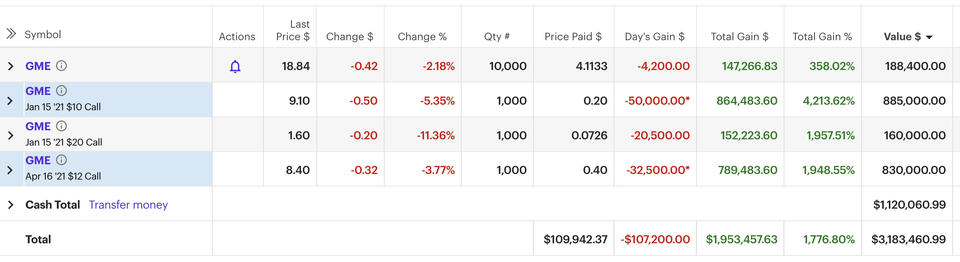

The result: Short sellers — especially Melvin Capital — had to purchase shares to close out their contracts as they expired. This created more demand for shares and each day the price of the stock was driven up. Take a look at the result’s of Keith Gill’s trades below as depicted on Reddit:

Implications

With the demand outpacing supply of GME stock on a massive scale, the stock shot through the roof. This caused a number of larger hedge funds to lose a mark-to-market loss of $19.75 billion to date. The purchase of GME was temporarily halted by a number of brokers — to includeRobinHood — for a period of time this week leading redditors to decry that the system was rigged as hedge funds influenced the trading halt to preserve their capital. It was a classic David vs. Goliath story that saw media coverage spike and even invoked a congressional investigation. While there are some more complexities to options trading, we hope that this served as a solid explanation to our readers.

We hope that you enjoyed this explanation of the week’s events and will subscribe. Happy Trading !(please trade responsibly!)

Enjoy the contents of this post? Subscribe below to get the latest content delivered to your inbox!

Hello! I’ve been reading your weblog for a while now and finally got the courage to go ahead and give you a shout out from Humble Tx! Just wanted to say keep up the fantastic work!

LikeLike